Top Industries to Watch in the Philippines in 2024

Berns San Juan: Today we’re talking about the top industries to watch out for in the Philippines, specifically some of the top 5, and then I’ve got one honorary mention in. Let’s do a quick rewind through 2023.

A lot of people might not know, but we sort of stole the spotlight in terms of being the fastest-growing economy in Southeast Asia. I know that not a lot of Filipinos are very, you know, we’re not cheerleaders for our own country, but hey, I think we should take our victory laps where we can. The Philippines boasted a closing growth rate of 5.6%. This is the strongest in Southeast Asia. There were modest gains everywhere.

But I think, even compared to Vietnam by the way, which is just doing amazing over the past decade, Vietnam closed at a growth rate of about 5.5%, and then you’ve got Singapore, Thailand, and Malaysia with 1.1 per Singapore, 1.9 increase in Thailand, and the 3.7% increase in Malaysia in terms of their growth rates. This calls for some congratulations to everybody in the private sector and everybody in the public sector and everybody who is a contributing, productive, working member of society.

The growth is attributed to a lot of us going, like a lot of us adapting to the new normal. There has been a resumption of commercial activities. There is more spending on public infrastructure. There is a lot of growth in digital finance services, and I’ll talk more about that later, and a lot of sectors grew with transportation and storage growing by 13%, construction by 9%, financial services by a modest 9% and I’ll explain why that’s modest, which seem to be the best performers overall.

There’s no success story though, like this is a very nuanced story. Like I think we cannot ignore the fact that despite a 5.6% improvement in GDP, let’s also remember that inflation last year closed close to 6% in 2023. But with our interest rates going or sorry with our inflation going down to the average of 2 to 4% in the Philippines estimates say it should be at about 3.2 to 3.6 by the close of 2024. The outlook still looks pretty sunny because the government is still aiming for a total of 5-6% growth.

Oh, by the way, a growth rate of 5.6% beats China’s 5.5% last year, right? So yay us! Now there are a lot of scenarios, I think there are conservatively optimistic, modestly optimistic, and very optimistic views about the Philippine economy, right? The conservative estimates think that we will continue at a sustained growth rate of about 4.8%. The modestly optimistic ones think we’ll grow at about 5.2%, and of course, the aggressive ones think we’ll grow at about 6.1%. I would say my aggressively optimistic view is that 6.1 should be pretty easy to beat for a country with a lot of resources and potential like ours.

Well, welcome to another episode of the Truelogic DX Podcast. My name is Bernard and let’s dive into some of the key industries to look out for in the Philippines alongside the projected expansion, the projected trends, the projected perception that the market will have for them, and some business opportunities for you because I’m assuming you are a productive decision-making member of society.

Financial Services Industry

The first industry that I wanted to highlight is the financial services industry. For a very specific reason, they are the third largest industry in the country. A lot of people are not aware that the financial industry is over, is a two trillion peso industry. It’s huge and that’s in terms of revenue. And it’s not two trillion from 2020 to 2023, it’s 2 trillion in one year alone. The margins in the industry are pretty respectable, about 38.2% in terms of net profit compared to revenue. That’s pretty high for an industry.

I mentioned earlier that their growth rate is at about 7% in 2022 or it’s estimated to be 7%. But a lot of us even know that in 2021, and 2022, financial services grew by 18.7% in terms of revenue. This is industry-wide, all financial services. So banks, insurance companies, online banking, e-wallets, they’re all bunched together in this one industry. The sector is probably still going to see a pretty decent amount of growth, right? Somewhere between 5% to 7%.

But let’s remember that a slowdown in growth is still growth, right? Like they’re still growing. I would also like to say that the 18.7% growth they did, which you can treat like a summer growth spurt, is impacted. Like that’s a result of recovery from COVID, right? Now, financial inclusion, and more digitalization, are major contributors to growth in this sector. Entrance of new players, the Bangko Sentral has been easing on the limits to players that can come into the sector allowing more unbanked people to be able to be part of this industry, of this vertical.

I’ll give a great example and so this is a shout-out to all of the hardworking people at the Bangko Sentral. They had a financial inclusion initiative and their goal was to increase the total number of basic deposit accounts in the country. And in 2023, they saw $22 million. The most important figure I think is that banking penetration has improved with the proportion of Filipino adults with real bank accounts increasing from two, to three years ago to the low 20s to 29%. This is like 2019, 2020, going all the way to 56%. This was at the beginning of 2022. That’s great progress, right? They did that in two years.

So from 29% in 2019 to 56% in 2021 across two years, they had almost doubled the total number of people who had formal bank accounts, people who left the unbanked status. Businesses in this sector, now that it’s rife with opportunity and it’s expanding, you’ve got Maya, you’ve got Gcash, you’ve got all of these… You’ve got all of these e-wallets, everybody’s got a trading app, all of the banks have their online banking app. Businesses in this sector will need to remain vigilant in terms of navigating security and fraud risk, right?

Because as the sector grows, if it is not vigilant, then the amount of fraud that grows with it also grows at the same rate. I would think also as not as much of a bright spot, there is a lot of growth in unsecured lending. And this is expected to continue, albeit at a slower pace than in the past two to three years. Part of the reason why I say not such a bright spot is I understand that this seems to be the avenue for most unbanked people or people without significant banking histories. These are for the people who are usually lower on the economic ladder.

But I will also say I’m a big promoter of lending products by banks. I understand the due diligence that they have to do. But if you’re looking for favorable terms, institutional companies are the best way to go. They’ll offer you the best rates and so forth. Right? So overall, third in the industry, great profits. Kudos to the financial services industry.

Energy and Power Industry

This is the fourth largest industry in the country and this accounts for a whopping one trillion pesos in terms of revenue industry-wide. The floor potential to grow in this industry is about 7%, but that can go all the way up to 12% as the country focuses on renewable energy generation. There is a goal to grow the total amount of energy produced in the country by 4% in 2023 and then 5% and then it grew by 5% in 2022.

I think the problem with that is for an industry with a floor potential, with a revenue growth potential of 7%, if you’re only generating 4% more power, that sort of puts the brakes on how much your vertical can grow. And so I think this requires a lot more investment. Maybe we ought to go a bit more aggressive on renewables. High global inflation and the fact that the Philippines is a net fuel importer do impact electricity prices. And this is part of the reason why the growth in the revenue is also higher.

I’m not sure if you guys pay attention to the filings of publicly traded companies, but Meralco is one of the most profitable businesses. Not a lot of that is necessarily due to more generation and distribution. A lot of that is also impacted by the increasing rates of electricity. And like everybody else, you know that, like for me, I’m like everybody else. That’s not necessarily good news. There are some moves, right? There are recent regulatory easing that’s being done to limit, which currently put a limit on our ability for exploration and development of energy resources.

I would say utilization of renewable energy resources could accelerate the growth in the country’s energy and power sector. I think this is probably how they break the 7% floor and grow faster than that. That’s probably also how we break the growth in energy generation from 4% to much larger. So energy and power, they’re growing pretty well, fourth largest industry. It is a trillion-dollar industry.

Wholesale Trade and Consumer Retail Industry

Now, let’s talk about something nearer and dearer to me, probably also nearer and dearer to you, and also a bit more exciting. The wholesale trade and consumer retail industry, yes, are lumped together. And they’re expected to be stable through 2024 at 4% for wholesale trade and 5% for retail, respectively. Inflation will continue to put consumers under pressure, but while inflation rates might fall, and it’s predicted to be, you know, optimistically, we try to hit between 3.2% to 3.8% by 2024. Commodity prices can remain elevated in the near term, which is a concern for Filipinos.

But you know, I also think, by the way, that this seems to be always like this seems to be an evergreen concern for Filipinos. So in response to challenging economic conditions, 92% of consumers have changed their shopping behaviors. A lot of this is being felt by luxury brands and a lot of this is being a lot of the benefits are being felt by the more mainstream brands, retail providers that offer promotions, and so on. But this is a… it’s retail is a pretty big industry in the country.

Manufacturing Industry

This is the leading industry in the country in terms of revenue. By a mile, a mile. Manufacturing accounts for almost 5 trillion in aggregate revenue. Despite the slowdown in 2020 due to COVID, they did make a rapid recovery from 2021 to 2022, growing at over 17% year on year, just 2021 to 2022. That’s an impressive cumulative annual growth rate. Manufacturing is a key contributor to the Philippine economy which sort of makes sense at this stage in our development. We should be a manufacturing company.

I think our services industry took a great leapfrog, but this is a great industry to watch out for. It is still 19% of the GDP of the country and it employs about 7% of the eligible labor force. And it grows in line with GDP year on year pretty much, right? Like at about 6%, 7%, and it’s estimated to grow by another 6% this year. The Philippines is also likely to benefit from increasing geopolitical tensions. You guys should know what I mean when I say geopolitical tensions because it’s happening off of the coast of Palawan, right?

As Western countries and US allies near shore and French shore, we are likely to become beneficiaries of those policies because other countries are looking to make their supply chains more resilient. Some other beneficiaries of these geopolitical changes have been India, right? Like I’m sure it’s probably not news if you’re listening to this podcast, I’m sure you’re pretty plugged into global news. Apple has continued to expand its production as Foxconn scales down production in China, they scale up production in India, right? That’s an example.

Or as an example, China is no longer the US’s largest trading partner, it is now Mexico, right? As they pay more attention to the North American pre-trade agreement. So near-shoring, French-shoring, and on-shoring are all meant to make supply chains more resilient and create more opportunities in manufacturing for the Philippines. As another, I think eye-opener, people might not be aware but there’s a lot of buzz about semiconductors I think a lot of people don’t appreciate that 45% of Philippine exports are not coconuts and mangoes. They’re semiconductors.

We import raw materials to produce semiconductors and 45% of Philippine exports are semiconductors. Now what could accelerate this? Even though we are a semiconductor exporter, we are not producing anywhere near the state-of-the-art semiconductors that are being produced in Japan, South Korea, and not Taiwan. However, more investments into STEM capabilities in the country could help attract investment and development into this sector.

IT-BPO Industry

The ITBPO industry or the ITBPO sector is on track to reach its long-term target. About 38 billion dollars are forecasted for its revenue in 2024, which is pretty consistent with previous years, right? Normally if you want to know what the ITBPO makes as a sector, they are almost always roughly 10% of the country’s GDP, about 9 in this case, but they’re almost always at about 9 to 10% of the country’s GDP. I think we were a net positive recipient in terms of the benefits of COVID.

The fact that I will say kudos to PLDT Converge, Smart, and all of the other internet service providers, right? Because we would have never been able, I think… if COVID happened five years earlier, we would have never been able to pull off what we did in 2020 with that much remote work. Just because internet connections five years ago, or I would say in 2016, were horrible. A portion of Truelogic’s manpower had already been working on hybrid setups as early as 2016. Again, because we’re a digital marketing company.

You don’t need all your writers in one room. You don’t need all of your creatives in one room. And so we hybridized the roles that we could hybridize. I could never have imagined high decision, high information, high decision, high information, high collaboration roles to be hybrid in 2016. And so we made what we could, we did what we could do in 2020. But I was so happy to see that internet connections and the internet infrastructure of the country were up to snuff when it was necessary.

And that’s why I think the ITBPO industry continues to blaze a trail. The industry continues to outperform headcount and revenue targets. And, you know, it is a leader in employment and services. I think it should be no surprise that the majority of employment in the ITBPO sector is in the millennial generation. Now, just as a side note, remember how I talked about retail and how they’re growing? Guess who influences that the most? These guys.

The millennials who are employed in the ITBPO sector account for 59.6% of all e-commerce in 2023. That’s insane. So 59.6% is because they’re grouped into two, right? I think these are grouped from 26 to 34 and 35 to 43, 44 I think. But that’s why they account for like 59.6%. That’s of all e-commerce. They, by the way, the millennials, are also the fastest-growing middle class in the country. The country is actually in pretty good shape because I think unlike developed countries where economists are saying the millennials will never become wealthier than their parents, that’s not true here.

That is not true here yet. And so it is the millennials that are, the millennials have a lot of opportunities for prosperity. A lot of that is thanks to the growth in this industry. Demand from global companies for offshoring is expected still to increase due to the cost of payment strategies and preference for Philippine ITBPO services. Because no offense, Filipinos sound like me. And I’m not going to talk about what other people sound like. Okay. New work setups, I think continue to emerge. The ITBPO sector has proven to be very flexible when it comes to work arrangements allowing for remote first in-premise and hybrid setups. And this translates to a lot of net benefits. There are also downsides. Remember, if only half the people, if a building only has half the occupancy, then it can only support half of the economy that goes around that commercial space. But the flexibility in the setup could lead to a 10 to 30% increase in employee retention.

It impacts the loss of productive hours in terms of getting stuck in the commute, which I do every day, by the way. An increase in talent enablement, the estimate is about 350,000 more able bodies generated by these hybrid setups. And a potential reduction in greenhouse gas emissions because millennials, care about this number, about 1.4 to 1.5 million tons of CO2 per year.

And I’d say I feel it, right? Like, let’s be sure we all have our gripes about EDSA, but let’s face it, it’s not as bad as the traffic in 2019. Right? Like it just isn’t. It is increasingly becoming more important that the ITBTO sector adapts to new technologies as businesses begin to harness automation and generate AI. To unlock productivity, there are already sectors in the country that have started to integrate AI into their strategies such as… I would say Lazada might be my first suspect.

Anything that personalizes the content in an app or a view has a lot of potential to benefit from generative AI in its current state. I’m not even talking about AI like three years from now. .. As for the last industry I want to talk about, I do want to give a special mention, not just because they’re my favorites, and these are our clients, but you got to give a shout-out and give a special honor to the real estate sector.

Real Estate Industry

If you look at it pound per pound, the real estate industry is only the seventh largest industry in terms of revenue, and it accounts for about half a trillion in revenue. As of 2023, the real estate industry is about half a trillion in revenue. But it is, even though it is the seventh by revenue, it is the third by profit. There are only two industries that beat it by profit, and that is the financial services industry, which has a very respectable margin, and the manufacturing industry, which just has a lot of profit simply because of scale.

Like there, half a trillion in manufacturing is almost five trillion. However, by a margin, real estate is the most profitable sector, boasting margins of up to 43.8%.

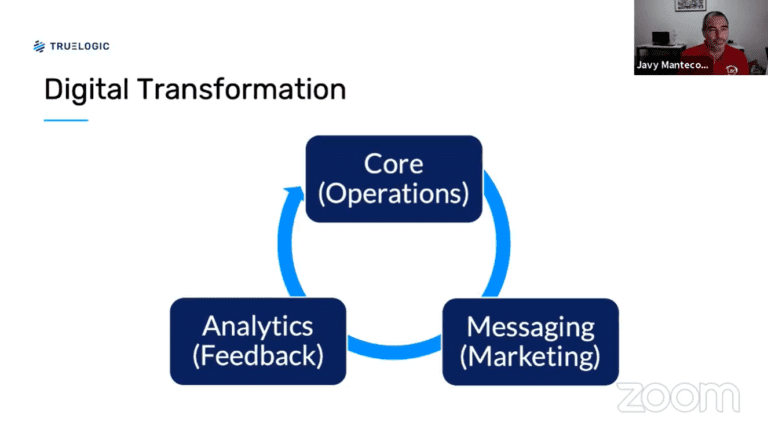

Implication for Businesses

The takeaway I’d like you to leave with from this conversation is that I am mentioning these verticals because if you are in B2B, these are your potential audiences, your potential customers. They are the ones with deep pockets, they’re not experiencing recessions, they’ve got great prospects, and you know what?

They probably need all the help that they can get. In the financial services industry, these guys are great clients. If you want to know what I’m talking about, go to our website and look at the logos there. But these guys are great clients. They’ve made great strides since 2015-2016 to become digital, to get closer to their customers. They’re not relying so much on in-branch staff to provide the maximum value that they can to their customers.

So if you’re a B2B provider, great industry to service. If you are an individual, great industry to work for. Like if you’re an individual, this is a great industry to work for. This is not one of those industries that are in a bubble or will crash and burn. They can provide you with great job security because guess what? The financial services industry is the third largest in the country. It’s a two trillion-dollar industry.

Energy and power are the fourth largest industry in the country. Okay, however, if you’re not working on the labor side, it would be great to become part of these companies. It would be great to become part of these companies, even retail power generation, the guys that are selling retail photovoltaic and batteries. It would be great to get on the ground because while power generation in the country grows only by 4 to 5%, revenue in the industry grows by about 7%.

And this is like food, clothing, and shelter. We’re always going to need it. We’re always going to need energy and power. Not the easiest industry to penetrate, because a lot of the companies that are publicly listed or that are part of the top 1,000 companies are power plants, right? But they are also making strides to becoming more digital, to reaching their customers, to talking to audiences.

So if you’re a business, it would be great to find inroads to talk to people in the energy and power sector. If you are an employee, this is a great sector to work in. Consumer and retail, are one of the faster-paced industries in the country. If you had said online marketplace seven years ago, people would have gone like, huh? And now you’ve got marketplace partnership managers as a job title.

So consumer retail, I think there are, except Divisoria, because they’re not going to be online, except Divisoria, working for the retail arm of the Ayala Group, working for the retail arm of the SM Group, working for Rustans, for SSI. For all of these guys that build their brands online including the Penshoppe group of companies, including Bench, like anybody that just retails online, it’s an exciting time to be part of this vertical.

Now, if you’re a B2B provider, that also means that if you build great relationships with these guys, they’re not going away anytime soon. This is one of the top five industries in the country. So none of them are going anywhere anytime soon. Okay, let’s talk about manufacturing. Yes, semiconductors are, a big deal in the Philippines. Again, our majority of exports are not mangoes, they’re not fish, they’re not bananas, they’re not coconuts.

By far, the largest export the country makes is in semiconductors. And if you’re family, like if you want to be employed and you want steady work and you want to be in a pretty secure industry, I would say this is a great vertical to be in. By the way, semiconductor manufacturing is not happening inside Metro Manila, right? These are probably happening in Batangas, Laguna, and whatnot. And so if you’re listening to this podcast and you’re in those areas, these are probably some really good jobs that you might want to take advantage of.

Oh, by the way, going back to wholesale trade and retail, I did admit to mentioning they are almost three trillion, right? Like manufacturing is almost five trillion, and wholesale and retail is almost three trillion. It’s the second-largest industry in the country. But back to manufacturing, there are more opportunities, I think in terms of manufacturing in the country, for example, a lot of the products that you find on the shelves are still imported products, and are only distributed by Philippine companies.

But over the years, I’ve met some terrific Philippine-based manufacturing companies, like companies that just used to provide the raw manufacturing power for international brands and now they’re creating their brands locally. There’s a lot of opportunity in manufacturing, such as investing in green technology just to make the cost of production lower, right? It is cheaper to have renewables running your factory rather than taking it off the grid.

I think upskilling in the labor force would be good, and investment in new technology would be great for them. And I think as a vertical, they are, they’re still, the grass is still green, right? Not a lot of the manufacturing sector in the country is very digitally mature. And they are looking for help, but they need to find the right partners. So again, if you’re a B2B provider, these guys are potentially great clients. And as the largest industry in the country, they’ve got the money to back it up. Right?

Last, ITBPO is a great industry. If you’re in it, don’t be a jumper. If you don’t feel that you’re finding yourself in the job that you’re doing, well, guess what? Suck it up. You’re in a great vertical that offers a lot of potential for growth that contributes about 10% to the GDP allows you to participate in the economy and makes you a very valuable, productive citizen. You’re not in a bad place. I think for the millennials that are working there, you just need to learn to find the angle so that you can fall in love with the work that you do. Right?

Like I understand being in the IT and BPO industry is not a calling, right? It’s not like you’re being called to be a celebrity or you’re being called to be an actor or you’re being called to be an artist. I get it, I get it, but it is a great contribution to society. Now, if these guys, now again, if you are a B2B provider and you’re wondering should the IT BPO sector be part of my audience target? Should I create a marketing push to start talking to these guys? I would say why not?

Because these guys are not limited by the economy of the country, right? IT BPO services, Australia, the US, UK, some of them are in Asian countries, Australia, they’ve got a near-infinite market. And so the growth potential that they can offer is huge. Plus, if you want to know what it’s like working in a melting pot, I think a BPO would be great because you get to work with multiple nationalities, you get to work with customers from different regions, and so on.

And I think the last bit is the amount of flexibility these verticals can own. You will never be able to demand from a bank the flexibility you will get from a BPO. Let’s just be clear about that. So as a career option, they are still great, almost guaranteed to make you a contributing member of society. If they are, I don’t think you need to do much to attract these guys as clients. They run a big operation, but if there is any vertical in the country that knows to focus on what they’re good at, it’s this vertical, right? Like.

They know they’re not good at producing food, so they look for providers to do that. They know that they’re not good at maintaining their facilities, so they get providers to do that. They’re not going to buy their buildings and then maintain their buildings because they don’t know real estate, they don’t know how to manage and administer the physical infrastructure. And so they will find providers to do that.

So with that, wound up pretty long but I did warn you this was a good news episode. I want to thank you for joining me on this episode on the industries to watch out for in 2024. I want to thank our friends at Podmachine and our marketing team for producing these episodes for you guys. Truelogic DX is available on Spotify, Google, and Apple accounts. And if you guys have any comments or any topics you’d like us to discuss in the future, let us know. We are listening to you largely on YouTube and Facebook. And I will see you in the next episode. Thank you very much and cheers.